What Is Selling Options?

In the previous blogs, we covered the fundamentals of options trading, including the mechanics of buying call and put options. Now, let’s dive into the world of selling options, a strategy that can be employed to generate income, hedge positions, and take advantage of time decay. In this chapter, we’ll explore selling call and put options, their respective risks and rewards, and when to use these strategies.

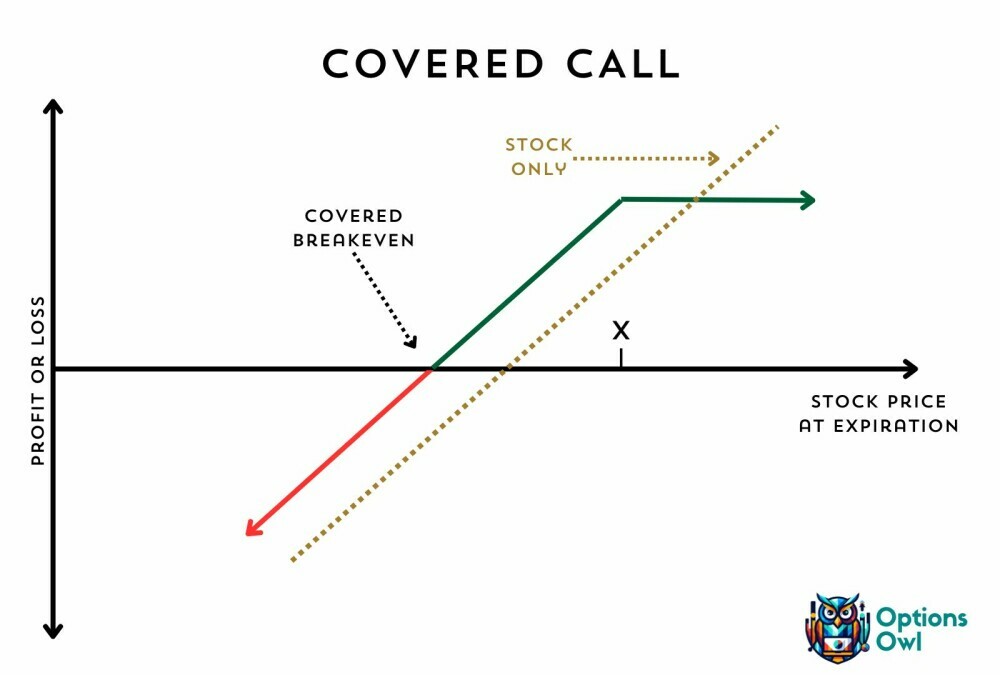

Covered Call Strategy

The covered call strategy involves selling call options while simultaneously holding an equivalent number of shares of the underlying asset.

Here’s how it works:

- Market Outlook: You have a neutral or slightly bullish outlook on the underlying asset, believing its price will either remain relatively stable or experience modest gains.

- Holding the Underlying Asset: You own shares of the underlying asset. Each call option contract you sell covers 100 shares of that asset.

- Selling the Call Option: You sell a call option contract with a strike price and expiration date of your choice. The premium received for selling the call option serves as income.

- Potential Outcomes:

-

- If the price of the underlying asset remains below the strike price of the call option by the expiration date, the option will likely expire worthless, and you keep the premium as profit.

- If the price of the underlying asset rises above the strike price, the option may be exercised by the buyer. In this case, you’re obligated to sell your shares at the strike price, but you still keep the premium as income. You may also benefit from the price appreciation of your shares up to the strike price.

Real-Life Example: Covered Call Strategy

Let’s say you own 1,000 shares of XYZ Corporation, currently trading at $50 per share. You decide to implement a covered call strategy:

- You sell 10 call option contracts with a strike price of $55 for a premium of $2 each. This generates a total premium income of $2,000 ($2 premium x 10 contracts x 100 shares per contract).

- If the price of XYZ Corporation’s stock remains below $55 by the option’s expiration date, you keep the $2,000 premium as profit.

- If the stock price rises above $55, the call option buyers may exercise their options. You’ll be obligated to sell your shares at the strike price of $55, but you still keep the $2,000 premium as income. You may also benefit from the price appreciation of your shares up to $55.

The covered call strategy allows you to generate income from your existing stock holdings while potentially benefiting from modest price gains in the underlying asset.

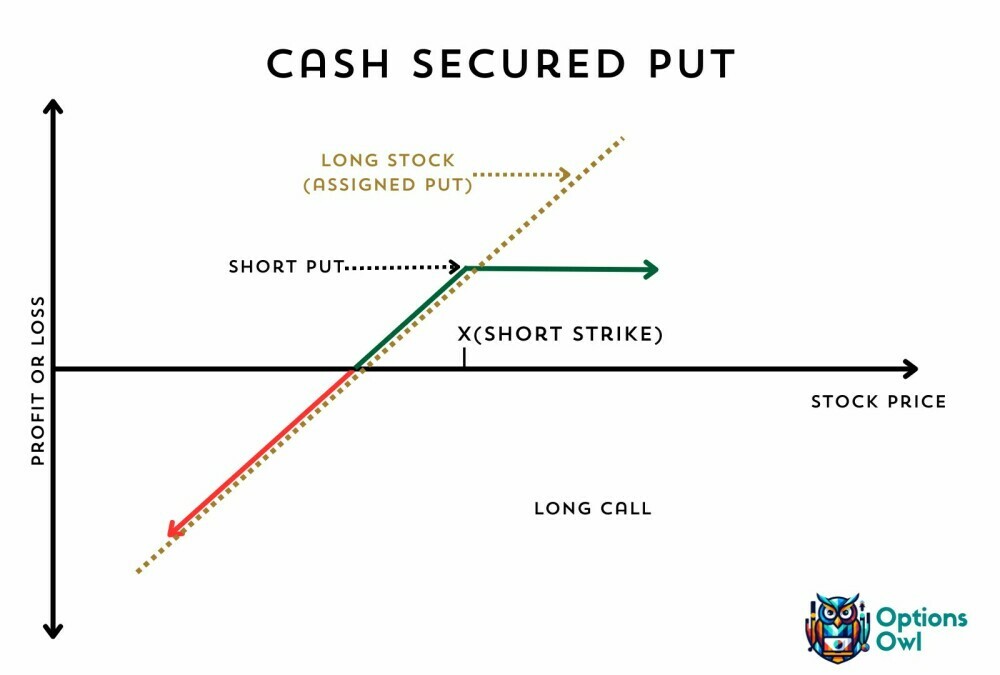

Cash-Secured Put Strategy

The cash-secured put strategy involves selling put options while having sufficient cash in your account to cover the potential purchase of the underlying asset if the option is exercised. Here’s how it works:

- Market Outlook: You have a neutral or slightly bearish outlook on the underlying asset, believing its price will either remain relatively stable or experience modest declines.

- Cash Reserve: You set aside enough cash in your trading account to cover the purchase of the underlying asset at the strike price of the put option.

- Selling the Put Option: You sell a put option contract with a strike price and expiration date of your choice. The premium received for selling the put option serves as income.

- Potential Outcomes:

-

- If the price of the underlying asset remains above the strike price of the put option by the expiration date, the option will likely expire worthless, and you keep the premium as profit.

- If the price of the underlying asset falls below the strike price, the put option may be exercised by the buyer. In this case, you’re obligated to purchase the shares at the strike price, but you can use the cash reserve you set aside to cover the purchase.

Real-Life Example: Cash-Secured Put Strategy

Imagine you have $5,000 set aside in your trading account, and you’re interested in generating income through the cash-secured put strategy:

- You sell one put option contract with a strike price of $45 for a premium of $2. This generates a premium income of $200 ($2 premium x 1 contract x 100 shares per contract).

- If the price of the underlying asset remains above $45 by the option’s expiration date, you keep the $200 premium as profit.

- If the stock price falls below $45, the put option buyer may exercise their option, and you would be obligated to purchase the shares at $45. However, you can use the $5,000 cash reserve you set aside to cover the purchase.

The cash-secured put strategy allows you to generate income while potentially acquiring the underlying asset at a lower price if it falls below the strike price.

Choosing the Right Strategy

Selecting between the covered call and cash-secured put strategies depends on your market outlook, risk tolerance, and financial goals. Here are some considerations:

- Covered Call Strategy: Use this strategy if you have a neutral to slightly bullish outlook on the underlying asset and want to generate income from your existing stock holdings.

- Cash-Secured Put Strategy: Opt for this strategy if you have a neutral to slightly bearish outlook on the underlying asset and are open to potentially acquiring the asset at a lower price.

Both strategies involve generating income through selling options while managing risks effectively. They can be valuable additions to your options trading toolkit, providing you with opportunities to earn premium income and enhance your overall returns.

We will explore more options strategies and delve into risk management techniques. These insights will help you become a more proficient options trader, capable of making informed decisions in a variety of market conditions.

Before moving on, take some time to absorb the concepts of selling call and put options.

It may be difficult to grasp these concepts initially. Familiarize yourself with the examples provided, as they illustrate how these strategies work in real-life trading scenarios.

In the next blog posts, we’ll delve deeper into these options strategies and their applications which may help in better understanding on how they work.