A Beginner’s Guide To Options Trading

Welcome to the world of options trading! We’ll embark on a journey to demystify the exciting and versatile realm of options trading. Whether you’re a complete novice or someone with a basic understanding of financial markets, we’ll start from the ground up and build a strong foundation for your options trading journey. Some concepts may take a longer time to understand, we will publish posts with different scenarios and smaller “bites” to help learning.

A Beginner’s Guide To Options Trading

Unlock the potential of the stock market with our step-by-step guide to mastering the art of options trading, even if you’re starting from scratch.

Before you invest in something, invest in time to understand it.

Understanding Financial Markets

Before we dive into the specifics of options, let’s begin with a brief overview of financial markets. Financial markets are like vast playgrounds where buyers and sellers come together to exchange assets. These assets can range from stocks and bonds to commodities like gold and oil. The primary purpose of these markets is to facilitate trade and investment, allowing individuals and institutions to buy and sell assets for various reasons, such as wealth preservation, income generation, and speculation.

In these markets, prices fluctuate based on supply and demand dynamics, economic factors, geopolitical events, and a myriad of other variables. This constant ebb and flow of prices creates opportunities for traders and investors to profit or protect their wealth.

The Basics of Options

Imagine you’re interested in buying a beautiful painting that you think will increase in value over time. However, you’re not ready to buy it outright today because you want to see if the price will go up or down. So, you make a deal with the seller. You pay a small fee for the right to buy the painting at today’s price, but you have the option to actually buy it anytime within the next three months.

This small fee is like the premium you pay for an option in trading. The painting is like the stock or asset you’re interested in. The right to buy the painting at today’s price, even if the value goes up, is similar to a “call option” in trading. If the painting’s value goes down, you can decide not to buy it, just like you can choose not to exercise your option if it’s not favorable. In this case, all you lose is the small fee you paid, similar to the premium paid for the option in trading.

To summarise using the above illustration, options trading is like paying a small fee for the right to buy or sell something at a set price within a certain period, without the obligation to do so. It’s a way to bet on the future price of an asset, with limited risk.

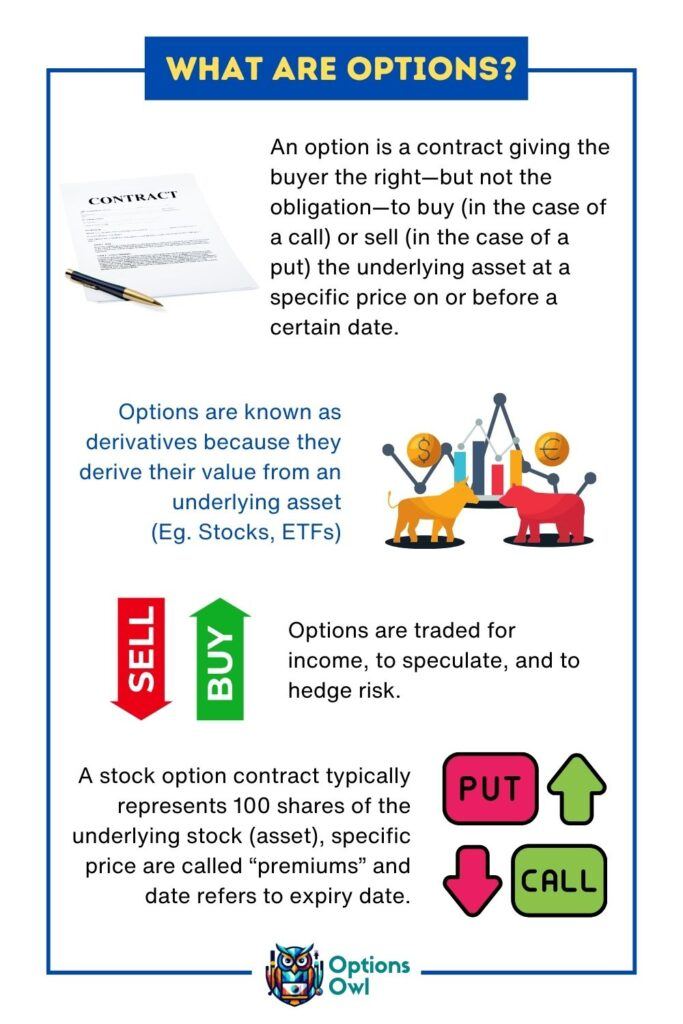

Now, lets answer the question, What are options?

Options are contracts giving the buyer the right but not the obligation to buy (in the case of a Call) or sell (in the case of a Put), the underlying asset (stocks or ETFs) at a specific price (called the Strike Price) on or before a certain date (called the Expiry Date).

The Option buyer will pay a fee (called the Premium) and the Seller of the option will collect the fee (called the Premium).

Therefore, an option is a contract between two parties—an option buyer (holder) and an option seller (writer).

Option Buyer (Holder): The option buyer pays a price (called the premium) to the option seller for the right, but not the obligation, to buy (in the case of a call option) or sell (in the case of a put option) an underlying asset at a specified price (known as the strike price) on or before a predetermined date (the expiration date).

Read Related: Buying Options

Option Seller (Writer): The option seller, often referred to as the writer, is obligated to fulfill the terms of the contract if the option buyer decides to exercise their right. For taking on this obligation, the option seller receives the premium from the buyer.

Read Related: Selling Options

One of the most distinguishing features of options is their flexibility. Unlike stocks, where you own a piece of a company, options provide you with the ability to control an underlying asset without actually owning it. This feature can be particularly advantageous for various trading and investment strategies.

Advantages of Options Trading

Now that you have a basic understanding of what options are, let’s explore why options trading is worth your attention:

- Limited Risk, Unlimited Reward: With options, you know your maximum potential loss upfront—the premium you paid. This limited risk can be a comforting factor for traders. On the flip side, options provide the opportunity for unlimited rewards, making them an attractive instrument for profit potential.

- Versatility: Options offer a wide range of strategies that can be tailored to different market conditions and investment goals. Whether you’re bullish, bearish, or neutral on a particular asset, there’s likely an options strategy that aligns with your outlook.

- Leverage: Options allow you to control a more substantial position in an underlying asset with a relatively small investment. This leverage can amplify your gains if the market moves in your favor.

- Risk Management: Options can be used as a tool for risk management. They provide effective ways to hedge your existing positions and protect your portfolio from adverse market movements.

- Income Generation: For income-focused investors, options can be used to generate regular income through strategies like covered calls and cash-secured puts.

Key Terminology

As you continue your journey into options trading, you’ll encounter a unique set of terms and concepts. To help you navigate this specialized language, let’s introduce some essential terminology that you’ll encounter throughout this book:

- Premium: The price paid for an option contract. It’s like the cost of admission to the options market.

- Strike Price: The predetermined price at which the underlying asset will be bought or sold if the option is exercised. Think of it as the agreed-upon price tag.

- Expiration Date: The date when the option contract expires. After this date, the option may no longer be valid.

- In-the-Money (ITM), At-the-Money (ATM), Out-of-the-Money (OTM): These terms describe the relationship between the option’s strike price and the current market price of the underlying asset. ITM options have intrinsic value, ATM options have strike prices near the current market price, and OTM options have no intrinsic value.

In the articles that follow, we’ll delve deeper into these concepts and explore practical strategies for trading options. You can take your time to finish the basic articles and come back to learn more. You’ll have a solid grasp of options trading fundamentals and be well on your way to making informed decisions in the dynamic world of financial markets.

Let’s embark on this exciting journey together, as we unlock the potential of options trading.

Read Next: Understanding Call and Put Options