What Is Buying Options?

In the previous blog posts, we’ve explored the basics of options trading, including what options are and how they work. Now, it’s time to delve into buying options, which is a popular strategy among traders seeking to profit from price movements in the underlying asset.

In this post, we’ll discuss two fundamental strategies for buying options: the Long Call Strategy and the Long Put Strategy. Additionally, we’ll provide real-life examples and case studies to illustrate how these strategies work in practical trading scenarios.

Long Call Strategy

The Long Call Strategy is a bullish options strategy employed when you expect the price of the underlying asset to rise. Here’s how it works:

- Market Outlook: Bullish (Expecting price to rise).

- Buying Call Options: You purchase call options that grant you the right (but not the obligation) to buy the underlying asset at a specified price, known as the strike price, before or on a specific expiration date.

- Pay the Premium: To buy call options, you pay a premium to the option seller. This premium is your upfront cost for the trade.

- Profit Potential: Your profit potential is theoretically unlimited if the price of the underlying asset rises significantly above the strike price of the call option. Your profit equals the difference between the asset’s market price and the strike price, minus the premium paid for the option.

Real-Life Example: Long Call Strategy

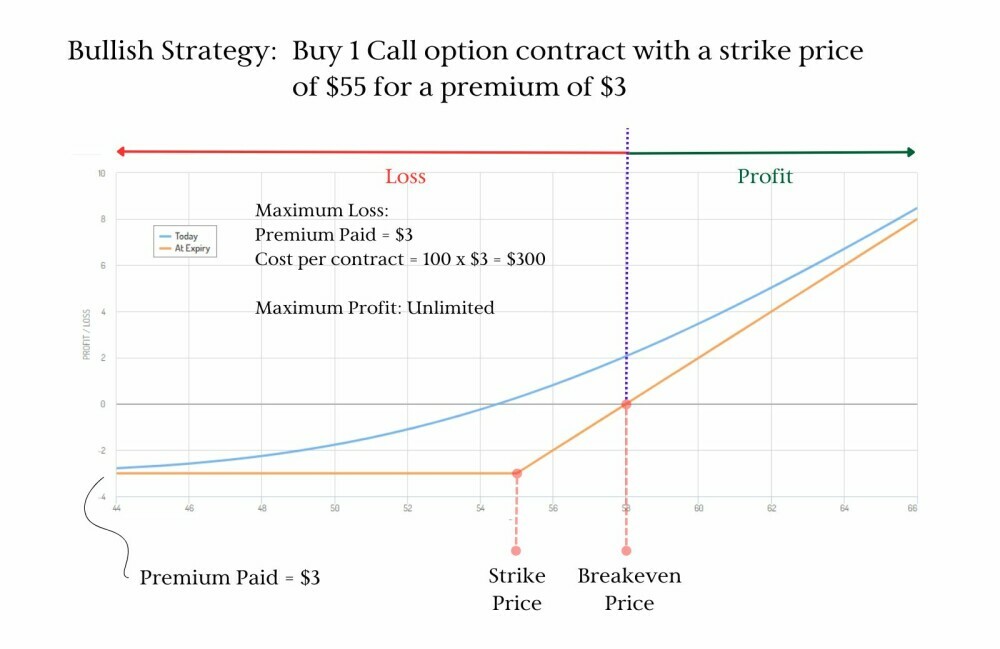

Let’s say you’re bullish on XYZ Corporation, which is currently trading at $50 per share. You believe the stock’s price will increase in the near future. To implement the Long Call Strategy:

- You buy one call option contract with a strike price of $55 for a premium of $3. This contract covers 100 shares, so the total premium cost is $300 ($3 premium x 100 shares).

- If the price of XYZ Corporation’s stock rises above $58 (the strike price plus the premium paid) by the option’s expiration date, you start to profit. For each dollar the stock price rises above $58, your profit increases by $100 (100 shares x $1).

- If the stock price doesn’t rise above $55 by the option’s expiration date, you have a limited loss equal to the premium paid ($300 in this case).

The Long Call Strategy allows you to benefit from a bullish market outlook while defining your maximum potential loss.

Long Put Strategy

The Long Put Strategy is a bearish options strategy used when you expect the price of the underlying asset to fall. Here’s how it works:

- Market Outlook: Bearish (Expecting price to fall).

- Buying Put Options: You purchase put options that grant you the right (but not the obligation) to sell the underlying asset at a specified strike price before or on a specific expiration date.

- Pay the Premium: Similar to the Long Call Strategy, you pay a premium to the option seller to buy put options.

- Profit Potential: Your profit potential is theoretically unlimited if the price of the underlying asset falls significantly below the strike price of the put option. Your profit equals the difference between the strike price and the asset’s market price, minus the premium paid for the option.

Real-Life Example: Long Put Strategy

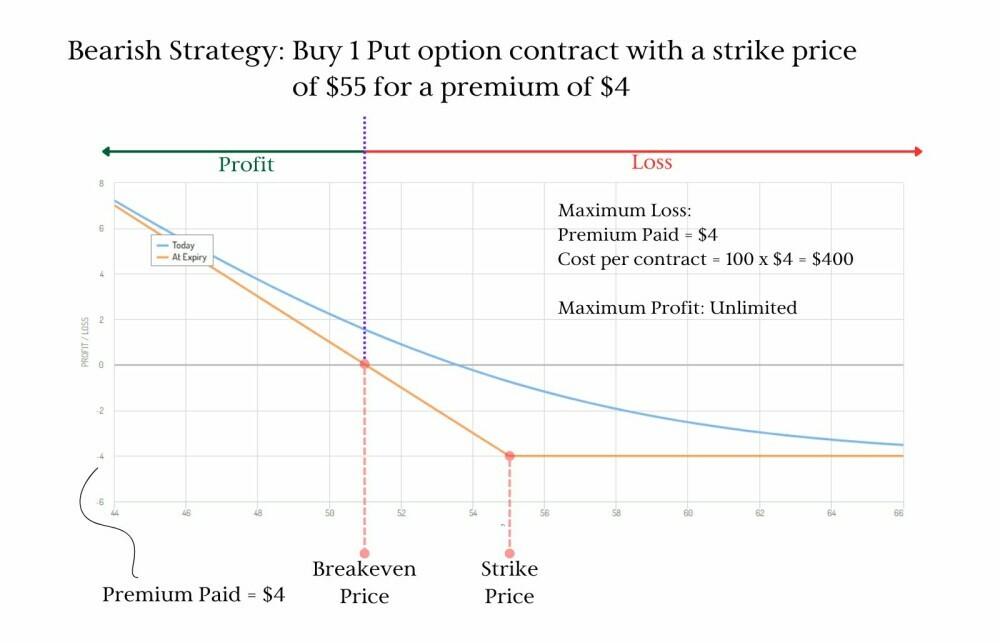

Suppose you’re bearish on ABC Corporation, currently trading at $60 per share, and you anticipate a price decline. To implement the Long Put Strategy:

- You buy one put option contract with a strike price of $55 for a premium of $4. The total premium cost is $400 ($4 premium x 100 shares).

- If the price of ABC Corporation’s stock falls below $51 (the strike price minus the premium paid) by the option’s expiration date, you start to profit. For each dollar the stock price falls below $51, your profit increases by $100 (100 shares x $1).

- If the stock price remains above $55 by the option’s expiration date, your maximum loss is limited to the premium paid ($400 in this case).

The Long Put Strategy allows you to profit from a bearish market outlook while limiting your potential loss to the premium paid for the option.

Practical Insights

When buying options, here are some practical insights to keep in mind:

- Expiration Dates: Be aware of the expiration date of the options you buy. Options lose value as they approach their expiration date due to time decay.

- Strike Prices: Choose strike prices that align with your market outlook. In the Long Call Strategy, select a strike price above the current market price if you anticipate a bullish move. In the Long Put Strategy, choose a strike price below the current market price for a bearish outlook.

- Premium Costs: Consider the premium costs carefully, as they impact your breakeven point and potential profit. Higher premium costs require larger price movements in the underlying asset to be profitable.

- Risk Management: Always implement risk management techniques, such as setting stop-loss orders, to limit potential losses.

In the next blog, we’ll explore selling options, another essential aspect of options trading, where traders generate income by offering options to other market participants.

Before moving on, take time to grasp the concepts of the Long Call and Long Put Strategies. Familiarize yourself with the real-life examples provided, as they illustrate how these strategies can be applied in actual trading situations.